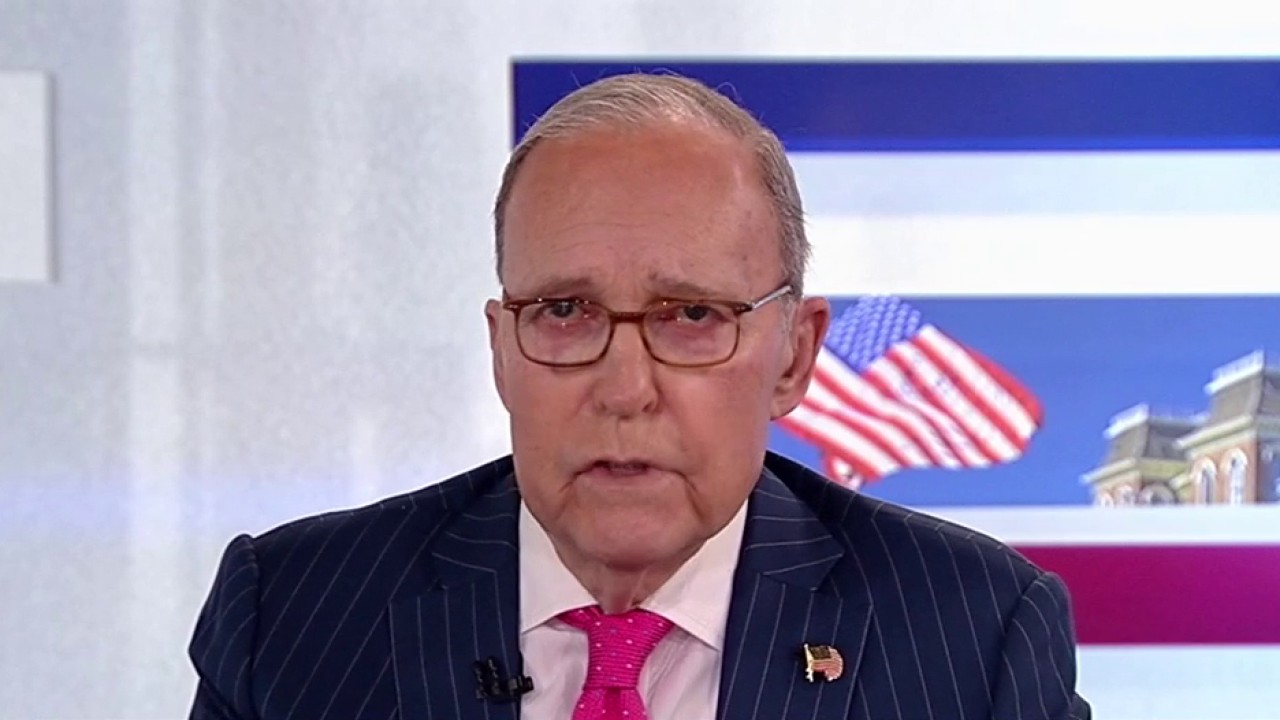

LARRY KUDLOW: Are booming stocks signaling a Trump boom?

Since the April bottom that followed some tariff confusion, the Dow Jones is up 27%, NASDAQ up 53%, and S&P up 37%. We don’t have a lot of official numbers because of the government shutdown, but I’m gonna go by the huge stock market performance. It’s telling us there’s a boom ahead. We may already be in it. And it’s backed up by Trumpian economic policies. And it’s also telling us that profits are strong — and profits are the mother’s milk of stocks and the lifeblood of the economy.

In particular, there’s a CapEx boom throughout all business. And much of that is from the immediate cost expensing from one, big, beautiful bill, machinery, equipment, factories, advanced technologies, AI, quantum computing. It’s all moving ahead. And though leads and lags in the economy are hard to figure, this is just the beginning of what will be known as the Trump boom and people will prosper.

By the way, it’s not only the business side, but next year consumers are likely to get anywhere from $150 to $200 billion from IRS withholding rate changes for things like tax-free tips, over time, and seniors. These are changes made this calendar year, but they kick in next year. And remember also that business booms mean good paying job booms.

White House deputy chief of staff for policy Stephen Miller discusses President Donald Trump floating tariff rebate checks and previews the administration’s future economic focus on ‘Kudlow.’

And please remember also that supply-side policies of tax cuts and deregulation are counter-inflationary. Throw in energy production, which is approaching now 14M barrels per day.

President Trump is right about gas prices. More than half the country now has a $2 handle on their gas price. And as far as affordability is concerned, after the Biden catastrophe, when real worker wages collapsed by roughly $4,000, those wages have already recovered in Mr. Trump’s first year by roughly $1,500. And this is just the beginning.

Now, I love this Door Dash report that shows the everyday essentials index has been flat over the past year. All these household costs holding steady. The cheeseburger index is up less than 4%. In many places it’s flatter, even lower. And the breakfast basics index has actually fallen 14% over the past 6 months. This report comes from millions of Door Dash transactions.

Former House speaker Newt Gingrich weighs in on the Trump administration’s economic focus on affordability push on ‘Kudlow.’

When you couple that with declining gasoline prices, and goods prices in general are up less than 1%, it’s hard to believe inflation is much of a problem.

Fortunately, the mass chaos of the Schumer shutdown is over. It’s good for growth and it will probably boost consumer confidence. The whole exercise was pointless and stupid, as a lot of hard-working people in the military and at home paid the price of the Democrats’ civil war. But now that that fiasco is over, we can get on with the Trump boom.

Share this content:

إرسال التعليق